Primary difference between OTC and Escrow?

Published at:

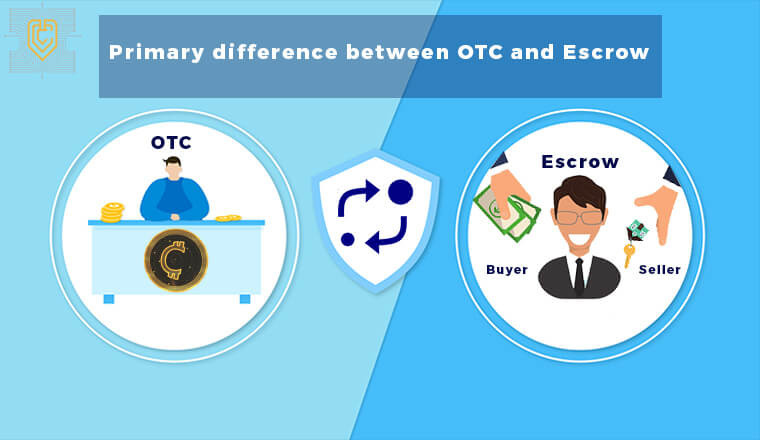

What is the difference between OTC trade and Escrow?

Perhaps one of the most hyped types of crypto trading at the moment is over the counter trading. Additionally, it would not be an understatement to say the escrow is the most hyped type of trading mechanism. Now put these two together, and you get OTC trading done using escrow services. In this article we want to discuss the differences between OTC and escrow. We will go through their concepts, mechanisms, advantages, applications, and finally make a conclusion.

Definitions

Before going any further ahead, it would be apropos to go over the definitions of both OTC and escrow. In this section the concepts regarding over the counter trading and escrow services are presented.

- OTC: there are a number of trades, involving any type of asset such as cryptocurrencies, that take place outside an exchange or off-exchange. These trades are known as over-the-counter or OTC trades. Such trades take place without the supervision of an exchange and directly between two parties. There are many differences between exchange trading and OTC trading.

- Escrow: It is a legal concept wherein a financial instrument or an asset is stored by a third party rather than two main parties of transaction; in other words, when the user works with this system, the third party plays the role of a formal guarantee and promisor. The funds or the assets are kept by the Escrow agency. This agency controls all the trade and transaction process and ensures that the required commitments will have been made thoroughly.

OTC Mechanism

The way over the counter trading takes place is quite simple, yet quite elegant. As we saw above, OTC trades are those that take place outside a standard and conventional exchange. Such type of trades can easily take place between two parties directly, thus the off-exchange nature. The two parties can find each other in nonconventional venues as well. Traditionally an exchange would bring trade parties together, whereas, in OTC trading, users can find each other online or in chat groups directly and engage in the trade of cryptocurrencies through an agreement between themselves.

Escrow Mechanism

On the other hand, using escrow services , users can invite transaction parties, make a contract and safely pay the charges by the methods provided by the Blockchain technology. Additionally, buyer, seller, and Escrow service provider, create a new shared wallet with their own private key. This new wallet, known as a MultiSig wallet, will only allow the withdrawal of the balance when at least two out of three of its creators provide conformation. In fact, in the shared wallet, three signatures have been created, and the entire trade fee will be deposited to this wallet. If the buyer and the seller come to terms about transferring the balance, the cost will be transferred to the seller’s account without the need for the escrow system. This is how an escrow trade works and provides assurance for all the trades.

Escrow Advantages

Perhaps the most obvious advantage of escrow is the ultimate level of security that it provides for the both sides of any contract. Additionally, any type of financial asset, including cryptocurrencies, can be traded using the platform provided by escrow services. It cannot be stressed enough that the level of security escrow provides for complete strangers to trade even the most valuable assets is absolutely unprecedented and unparalleled.

OTC Advantages

On the other hand, over the counter trading allows users to gain access to assets that are not listed on official and standard trading platforms or exchanges. Such as cryptocurrencies that are not yet listed by big players in the exchange market . As such, users will have the freedom to be able to trade any type of asset, listed or otherwise. Plus, there are many regulations, impediments, and obscurities that exist in conventional and traditional exchanges and trades that take place in them, while, such matters are not seen in OTC trading. Among them we can refer to legal regulations and lack of transparency.

Applications

Other than the applications that escrow services and OTC trading have on their own, a special partnership between these concepts has brought about never-before-seen applications that could change the exchange domain forever. As previously stated, OTC is a type of trading that is quite unconventional, which has many advantages that have not been seen before. In addition, we also stated that escrow is an infrastructure for trades to take place. One that provides unparalleled levels of assurance, trust, and reliability.

The combination of the two means OTC trades that take place with the help of escrow services. This means trades will be able to exchange literally all assets, even those unlisted and unconventional, without the impediments of pesky regulations, the lack of transparency, high commissions, etc., in addition to an incredible level of safety which is nothing short of full guarantee.

Conclusion

More and more OTC trades are being done using escrow services. What this means is that users will gain all the benefits from over the counter trading without its risks. Because trades that are taken place over the infrastructure of escrow services completely minimize the risks to trade parties. Over the counter trades taken place using escrow services take the field of finance, exchange, and trading truly to the next level.

Share:

Login with Counos

Login with Counos